Crypto Today: Bitcoin, Ethereum hover around key supports, Spot ETH ETF approval likely by July 4

- Bitcoin trades around $61,000 on Thursday as profit-taking by investors persists.

- Spot Ethereum ETF optimism helps Ether sustain above $3,400, Reuters reports ETF approval is likely by July 4.

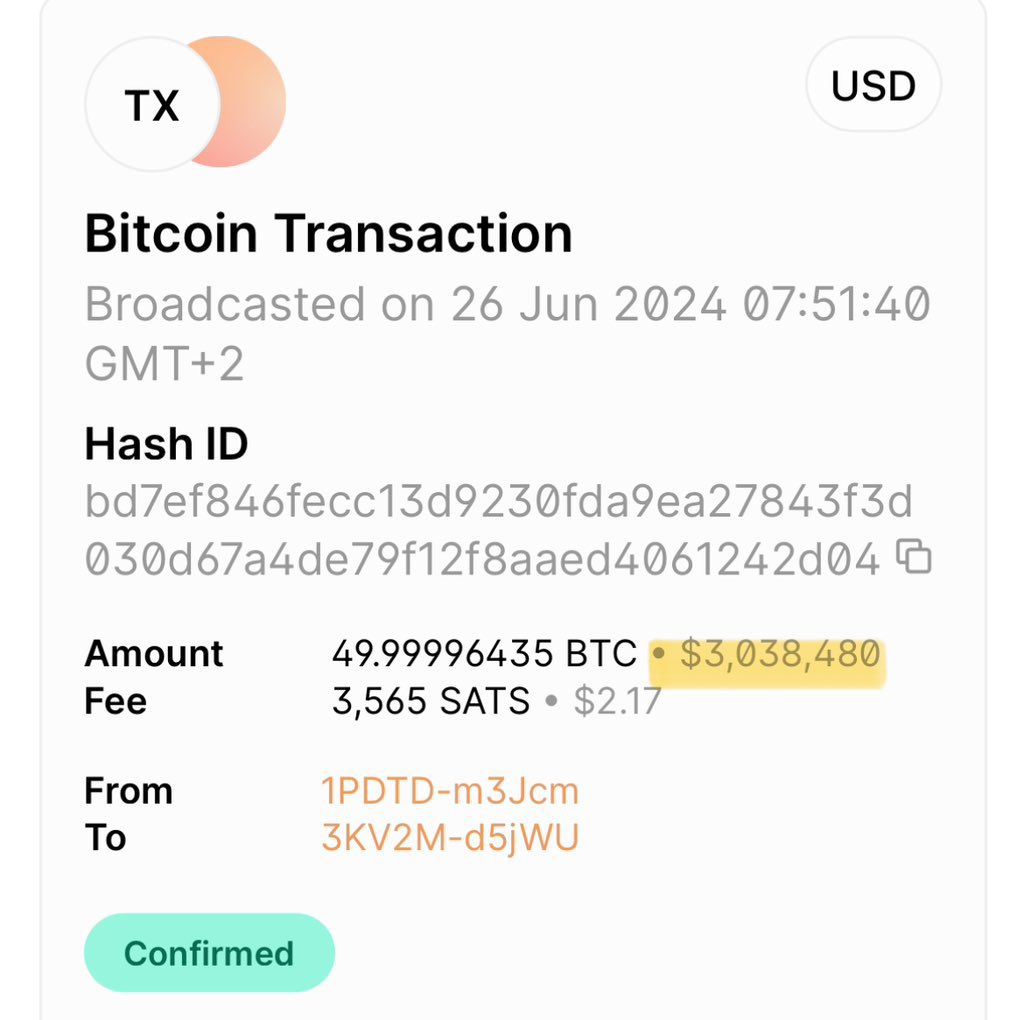

- A Satoshi era Bitcoin wallet moved $3 million in BTC late Wednesday, likely to realize gains.

Crypto update:

- BTC/USDT trades at $61,436 at the time of writing, hovering above crucial support at $61,000 on Thursday. The largest asset by market capitalization has sustained above support even as selling pressure persists and investors take profits.

Bitcoin price struggles around $61,000 as German, US government transfers weigh

- ETH/USDT trades at $3,435 on Thursday, wiping out nearly 4% value in the past seven days. Still, the optimism surrounding Spot Ethereum Exchange Traded Fund (ETF) approval persists. A Reuters report says that the US Securities and Exchange Commission (SEC) could approve the ETF as early as July 4.

Ethereum ETFs may launch on July 4, could see 40% rally afterwards

- XRP/USDT trades at $0.4721, around support at $0.47 on Thursday. For the ninth consecutive day, Ripple investors have realized losses, per Santiment data. Typically, this points to a capitulation and an upcoming recovery in XRP.

XRP stuck under $0.48 while Ripple CEO claps back at SEC Chair for recent remarks on crypto

- Meme coins, Artificial Intelligence (AI), Real World Asset (RWA) tokens offered traders buy-the-dip opportunities on Thursday after emerging as the top-performing categories in crypto.

Meme coins, AI and RWA crypto tokens could drive profitability in 2024

Chart of the day:

KAS/USDT daily chart

Kaspa (KAS) extended gains by over 22% in the past seven days on MEXC exchange. Unlike traditional blockchains, the Proof-of-Work (PoW) asset implements the GHOSTDAG protocol. This means transaction processing is faster, and the chain is highly scalable.

KAS/USDT daily chart shows that the asset could extend gains by over 9% and revisit its monthly high from June 5, at $0.1930. The asset finds support at $0.1713, the 23.6% Fibonacci retracement of the rally from the May 1 low of $0.1012 to the June 5 high of $0.1930.

In the event of a correction, KAS could dip to support at $0.1622, the June 25 high and the lower boundary of the Fair Value Gap, as seen on the daily chart.

Market updates:

- A Bitcoin wallet from the “Satoshi era,” the time when BTC founder Satoshi Nakamoto was active on public forums between 2009 and 2011, has been reactivated. On-chain data shows that the wallet had acquired BTC at $0.10 and moved it when the price was above $60,000, late Wednesday.

Bitcoin transaction by Satoshi Era wallet

- CEO of Helius Labs commented on the Cardano blockchain, alleging that the Ethereum-alternative chain was likely attacked. The executive shared details of what he refers to as a “DDoS” attack, in a tweet on X.

It seems Cardano was DDoSd attacked from

— mert | helius | hSOL (@0xMert_) June 27, 2024

*checks notes*

Someone sending it several transactions (less than 200)

The attack cost 250$/hour for 12 hours and was stopped by *checks notes* deregistering the attacker

Ok pic.twitter.com/TH4zB5un8P

- Axie NFT collection has noted an 690% increase in its active addresses since April, per data from DeFiLlama. The Axie Infinity (AXS) tokens lags behind with a 45% decline in its price in the same timeframe.

Since April, Axie monthly active addresses are up 690% from 26.5 k -> 209.6 k.

— Jihoz.ron (@Jihoz_Axie) June 27, 2024

Axie is also generating more monthly onchain revenue than the top NFT collections.

Step by step. pic.twitter.com/WlypXJBA6y

Industry updates:

- Coinbase sued the US SEC and the Federal Deposit Insurance Corporation for not complying with the Freedom of Information Act requests and asked the court to force the agencies to comply.

Coinbase lawsuit against FDIC

- Solana Mobile’s Chapter 2, or the newest version’s pre-order token holders, have surpassed 140,000.

BREAKING: The @solanamobile Chapter 2 pre-order token holders have surpassed 140K. pic.twitter.com/HCIrkmEoNa

— SolanaFloor (@SolanaFloor) June 25, 2024

- Kaspa (KAS), Ethereum Name Service (ENS) and Toncoin (TON) rank among trending coins. The assets have added 10%, 7.3% and 2.6% to their values in the past 24 hours.

Crypto market capitalization is nearly unchanged in the past 24 hours.