Stablecoin USDC deposits on exchanges hit one-year high of $228 million

- Stablecoin market capitalization is increasing, ratio to Bitcoin market cap is similar to previous all-time high.

- USD Coin deposits on exchanges climbed to a one-year high on Monday.

- CryptoQuant CEO says stablecoins have been used as buy-side liquidity in this cycle.

Stablecoin market capitalization is on rise as USD Coin (USDC) deposits on exchanges hit a one-year peak on Monday, June 24. Stablecoins play a pivotal role in the ecosystem since they are the fiat on-ramp for traders in the crypto ecosystem.

Ki Young Ju, CEO and co-founder at CryptoQuant, notes that stablecoins have acted as buy-side liquidity, per data from the tracker.

USDC deposits hit one-year peak

Bitcoin sustains above $61,000, and altcoins have started their recovery from the recent correction in prices. Crypto traders are likely buying the recent dip in cryptocurrencies, per IntoTheBlock data.

Lucas Outumuro, Head of Research at IntoTheBlock, noted that USDC net inflows into centralized exchanges hit a one-year high on June 24 at $228 million. Outumuro poses the question, “People depositing stables to buy the dip?”

USDC net inflows into centralized exchanges hit a one-year high yesterday of $228M

— Lucas (@LucasOutumuro) June 25, 2024

People depositing stables to buy the dip? $BTC $ETH pic.twitter.com/oAwDv4O1dX

It is likely that the stablecoin deposits to exchanges represent buyers lining up to buy crypto during the dip. The thesis is backed by Ki Young Ju’s recent tweet on X.

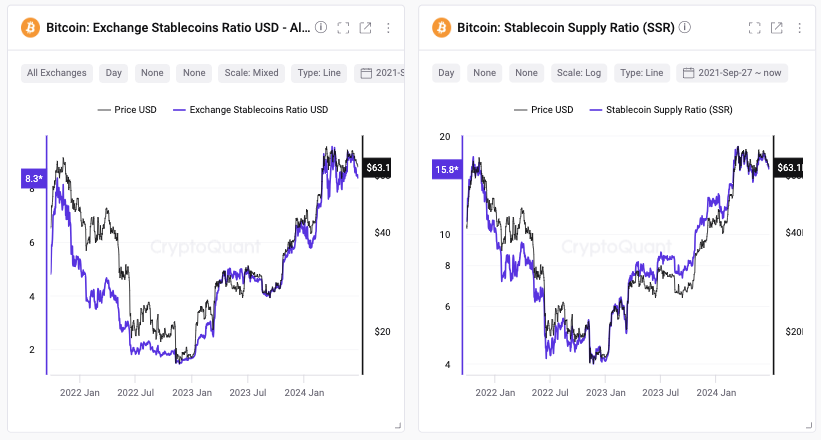

The CryptoQuant co-founder observed that stablecoin market capitalization is increasing, while its ratio to Bitcoin market capitalization is similar to the previous all-time high levels. The same applies to the exchange reserves ratio.

The two key metrics used to draw the conclusion are:

- Exchange stablecoin ratio, derived by dividing Bitcoin reserve by all stablecoin reserves across centralized exchanges.

- Stablecoin supply ratio, calculated by dividing the market capitalization of Bitcoin by the market capitalization of all stablecoins.

The CEO concludes that stablecoins have been used as buy-side liquidity. He mentions that new inflows are likely to drive the next leg up.

Bitcoin: Exchange Stablecoins Ratio, Bitcoin: Stablecoin Supply Ratio

Is it the right time to buy the Bitcoin dip?

The Bitcoin Market Value to Realized Value (MVRV) indicator is used to evaluate the tops and bottoms of the Bitcoin market and provides valuable information about traders' buying and selling behavior.

The MVRV ratio on a 30-day timeframe has proven to be an effective metric to identify an upcoming bounce in Bitcoin price. The following Santiment chart shows MVRV dips below 8.40% on numerous occasions in the past year and half, and Bitcoin price has rallied between 25% and 100% each time.

At the time of writing, Bitcoin price is $61,416, and MVRV is 9.69%. Therefore, based on the above observation, this is a good time for traders to buy the Bitcoin dip, per on-chain data.

[22.22.09, 25 Jun, 2024]-638549337899172831.png)

Bitcoin MVRV ratio (30-days) vs. price

Bitcoin rallied nearly 2% on Tuesday, and the seven-day return is a negative 7.66%.