Ethereum may need to shave off 4% of its value amid rally signs following ETH ETF updates

- Ethereum could see a 40% rally two months after spot ETH ETF goes live, says StoneX.

- SEC Chair says spot Ethereum ETF approval process "going smoothly."

- Ethereum may need to shed 4% of its value before staging a comeback.

Ethereum is down 1% on Wednesday following brokerage and financial services firm StoneX predicting a 40% gain for the largest altcoin two months after ETH ETFs go live. Meanwhile, Securities & Exchange Commission (SEC) Chair Gary Gensler provided positive updates that the spot ETH ETF approval process is going smoothly.

Daily digest market movers: 40% ETH price growth, ETH ETFs launch

A recent analysis by StoneX predicts that the launch of spot Ethereum ETFs could trigger a 40% growth in ETH's price two months after they go live. In a wider time frame, StoneX's model predicts that ETH's price will be between $2,142 and $12,621 over the next two years.

The company mentioned that its "conservative" predictions are due to the belief that NFTs won't see more mainstream attention as they did in 2021. The analysis also suggested that video games and real-world assets (RWA) — which many believe will boost TVL and user adoption — may not see tangible growth.

Prospective spot ETH ETF issuers filed their amended S-1 registration statements with the SEC last week following comments from the agency. The SEC approved issuers' 19b-4 applications on May 23 but also needs to greenlight their S-1s before ETH can begin trading.

The StoneX analysis follows Bloomberg analyst Eric Balchunas's suggestion that ETH ETFs will capture lower net flows than Bitwise CIO Matt Hougan predicted because "ETH futures ETF were a borderline flop."

Hougan predicted that spot Ethereum ETFs will attract up to $15 billion in net flows by the end of 2025. He arrived at the $15 billion figure by analyzing Ethereum's relative market cap compared to Bitcoin, international crypto ETFs volume, Grayscale Ethereum Trust conversion, and the Bitcoin "carry trade."

Yeah, I thought about that. It's a fair question.

— Matt Hougan (@Matt_Hougan) June 26, 2024

The largest ETH futures ETF (EETH) is only ~5% the size of the largest BTC futures ETF (BITO). I didn't adjust things downwards for two primary reasons:

1) My gut just says futures products are different;

2) At Bitwise, our…

Meanwhile, SEC Chair Gary Gensler commented in a Bloomberg event on Tuesday that the process of launching spot Ethereum ETFs is "going smoothly." He stated that the products going live depend on asset managers making full disclosures in their registration statements.

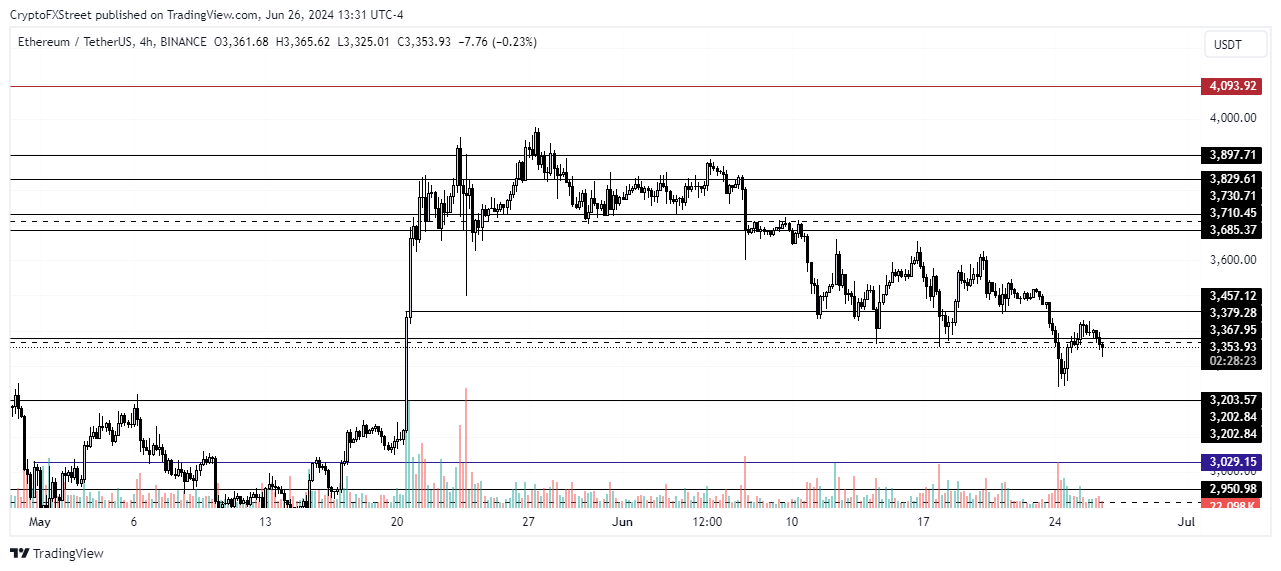

ETH technical analysis: Could Ethereum shed 4% of its value

Ethereum is trading around $3,350 on Wednesday, down nearly 1.2% in the past 24 hours. ETH's total liquidations in the past 24 hours have reached $21.82 million, with long positions accounting for 61% of liquidations and shorts 39%.

ETH open interest (OI) has been declining — although at a slow pace — sitting at $15.09 billion today. This indicates that traders are more cautious, especially as wider bearish sentiment seems to be overshadowing bullish sentiment around the potential launch of spot ETH ETFs.

Ethereum's 30-day Market Value to Realized Value (MVRV) ratio is at -7%, indicating all addresses that purchased ETH within the last 30 days are at an average loss of 7%. Historically, ETH often rebounds when the 30-day MVRV reaches -15% to -17%.

ETH/USDT 4-hour chart

As a result, ETH may need to shed 4% of its value to collect liquidity around the fair value gap of May 20, extending from $3,110 to $3,457 before a fresh rise. The $3,203 key support level could prove crucial in the potential decline to help ETH bounce back up.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.