Top meme coins DOGE, WIF, PEPE rally following market recovery

- Meme coin category is up 10%, with significant gains across tokens in the sector.

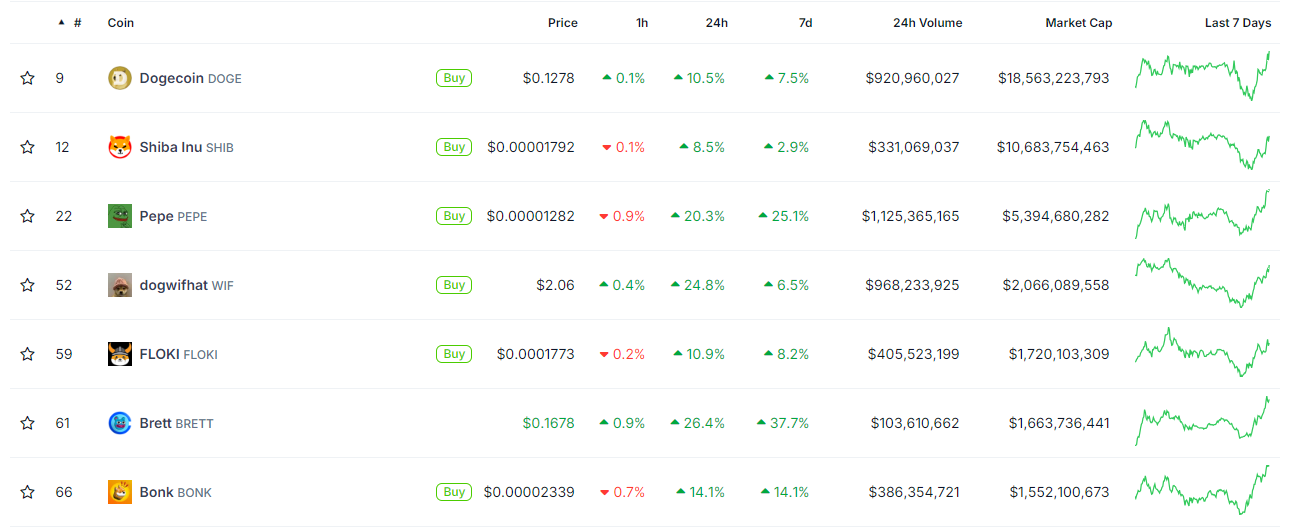

- DOGE, SHIB, and FLOKI have seen about a 10% gain in the past 24 hours.

- BRETT, WIF, and PEPE took a 20% leap.

Meme coins are leading the crypto market recovery on Tuesday following double-digit gains across Dogecoin (DOGE), PEPE, dogwifhat (WIF), FLOKI, BRETT, and others.

Meme coins stage comeback

Top meme coins took significant losses on Monday following FUD from Mt. Gox's upcoming Bitcoin creditors' repayment. With the news saturating the market, many expected the meme sector to see a second consecutive day of losses on Tuesday. Several analysts expected a rotation from meme tokens to major altcoins as the sector was the most affected.

However, meme coins are on course to defy earlier bearish sentiments, leading the crypto market recovery with significant gains. According to data from CoinGecko, the meme coin sector has witnessed over a 10% gain in the past 24 hours as buyers appear to be coming back into the market.

Earlier reports reveal that USDC stablecoin exchange net inflows hit a one-year high of $228 million on Monday. Some of these inflows may have been used to purchase meme coins.

The largest meme coin, Dogecoin (DOGE), is up more than 10% on the day, turning its weekly performance positive with a 7% increase.

Shiba Inu (SHIB) has been up nearly 9% in the past 24 hours, and it's on the verge of claiming the 0.000019 price level, where investors purchased over 424 trillion SHIB tokens, according to data from IntoTheBlock. If it successfully claims this level, it could prove a crucial support in the case of future price declines.

The dogwifhat (WIF) and BRETT tokens are among the large gainers, rising by 25% and 27%, respectively. WIF's rise would provide comfort for holders, considering it had largely underperformed other top meme coins in the past few weeks.

Since the beginning of June, WIF had been on a somewhat slippery slope until its huge gains on Tuesday. On the other hand, BRETT's 27% rise shows its holders are still expecting a further rise despite a 137% rally in the past month.

Meme coin category

It's important to note that as meme coins often see significant gains during market recoveries or rallies, they're also the most affected during market downturns.

Meanwhile, many crypto community members have speculated that the recent launch of Solana shareable links, due to their easy integration with websites and apps, could add fuel to the increased launch of meme coins in the current cycle.