Crypto Today: Bitcoin and altcoins begin recovery despite mounting selling pressure

- Bitcoin is currently trading at $61,200, up nearly 2% on Tuesday.

- Ethereum ETF issuers have locked in fees and seed investments, awaiting final approval from the SEC.

- The Fear and Greed index dropps to 30, the lowest level in eighteen months.

Crypto update:

- BTC/USDT is trading at $61,200, gaining 2% on Tuesday but wiping out nearly 9% of its value in the past seven days. Profit-taking by traders and the German government’s recent Bitcoin transfers have added to the selling pressure on BTC.

- ETH/USDT is trading at $3,366, up nearly 0.5% on the day, as optimism surrounding the Ethereum ETF brews among traders. Spot Ethereum ETF issuers have locked in fees and investments in anticipation of the final approval from the Securities and Exchange Commission (SEC).

- XRP/USDT is trading at $0.4760, recovering slightly from the near 6% decline in the past seven days.

- Meme coins and Artificial Intelligence (AI) category of tokens noted a recovery in market capitalization this week, per CoinGecko data. Top trending cryptocurrencies Popcat (POPCAT) is up 70%, Mog Coin (MOG) rallied 33%, and Maga Trump (TRUMP) climbed 27% in the past 24 hours.

Chart of the day:

SOL/USDT daily chart

Solana price seems to have formed a local bottom on the daily chart after posting a hammer candlestick on Monday. The altcoin is up 5% on Tuesday, and could extend gains by 20% if it climbs to the lower boundary of the Fair Value Gap at $163.78.

Market updates:

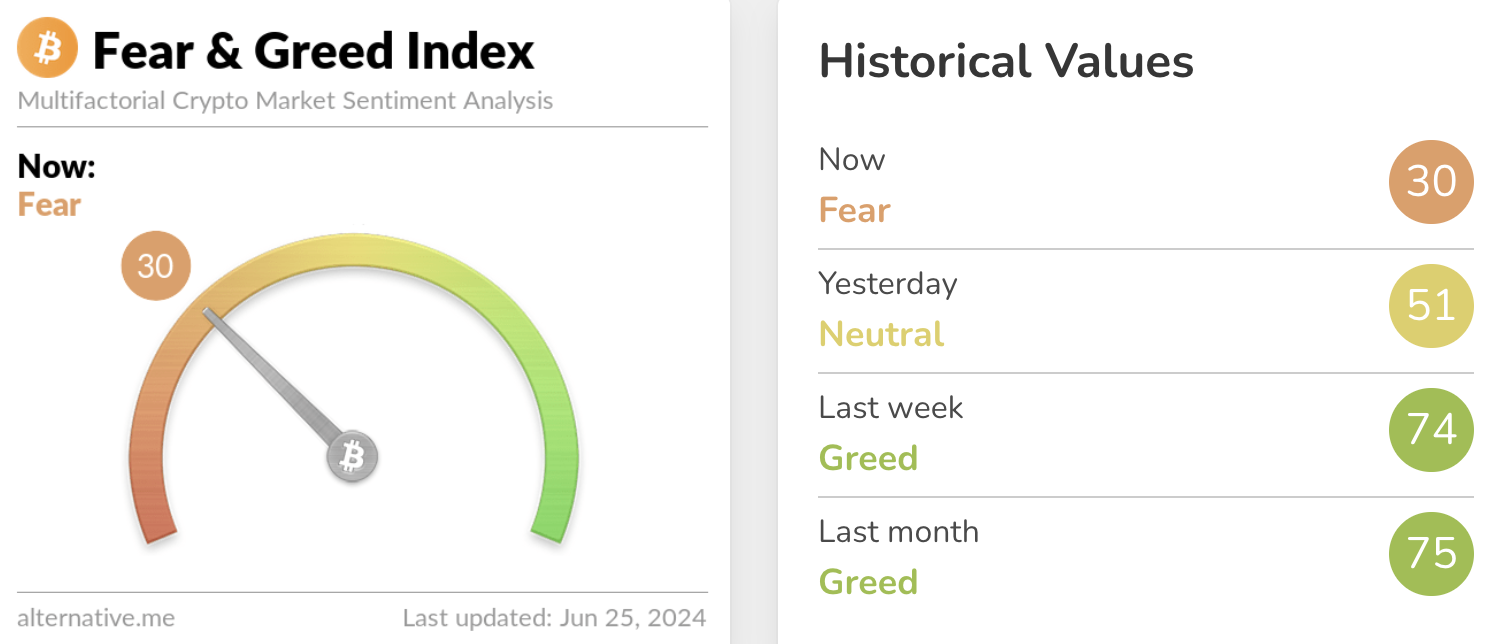

- The German government moved $24 million in Bitcoin to centralized exchanges early on Tuesday following the $65 million sent on June 20 and $130 million on June 19. These transfers have played a role in pushing the Fear and Greed index to 30 (fear), the lowest level in eighteen months. The index is used to ascertain the sentiment among crypto traders.

Fear and Greed Index

- News of Mt.Gox repayment of lost Bitcoin and Bitcoin Cash to creditors in kind starting in July also elicited a negative reaction among traders. There is a likelihood of higher selling pressure on Bitcoin if Mt.Gox repayment begins next month.

- Ethereum Spot ETF issuers are set for the approval from the US SEC, awaiting a green light from the financial regulator. Issuers have locked in fees and seed investments for the exchange traded products.

- Meme coins added 8% to their market capitalization in the past 24 hours, up to $51.47 billion, per CoinGecko data.

Industry updates:

- Tether pulled support for EOS and Algorand and will stop issuing Tether on the two chains. The transition is expected to be complete within 12 months.

Tether Announces Strategic Transition to Prioritize Community-Driven Blockchain Support

— Tether (@Tether_to) June 24, 2024

Read more: https://t.co/UCL1MJt2WO

- BNB Chain announced the Meme Heroes initiative, allocating $900,000 for liquidity pool support with plans to reinvest generated revenue and boost meme projects.

Introducing Meme Heroes

— BNB Chain (@BNBCHAIN) June 25, 2024

We’re allocating $900K for liquidity pool support with all revenue generated from these LPs to be reinvested back into the ecosystem to boost meme projects in the BNB Chain ecosystem!

Learn more via our blog below https://t.co/vHsl5ilcip

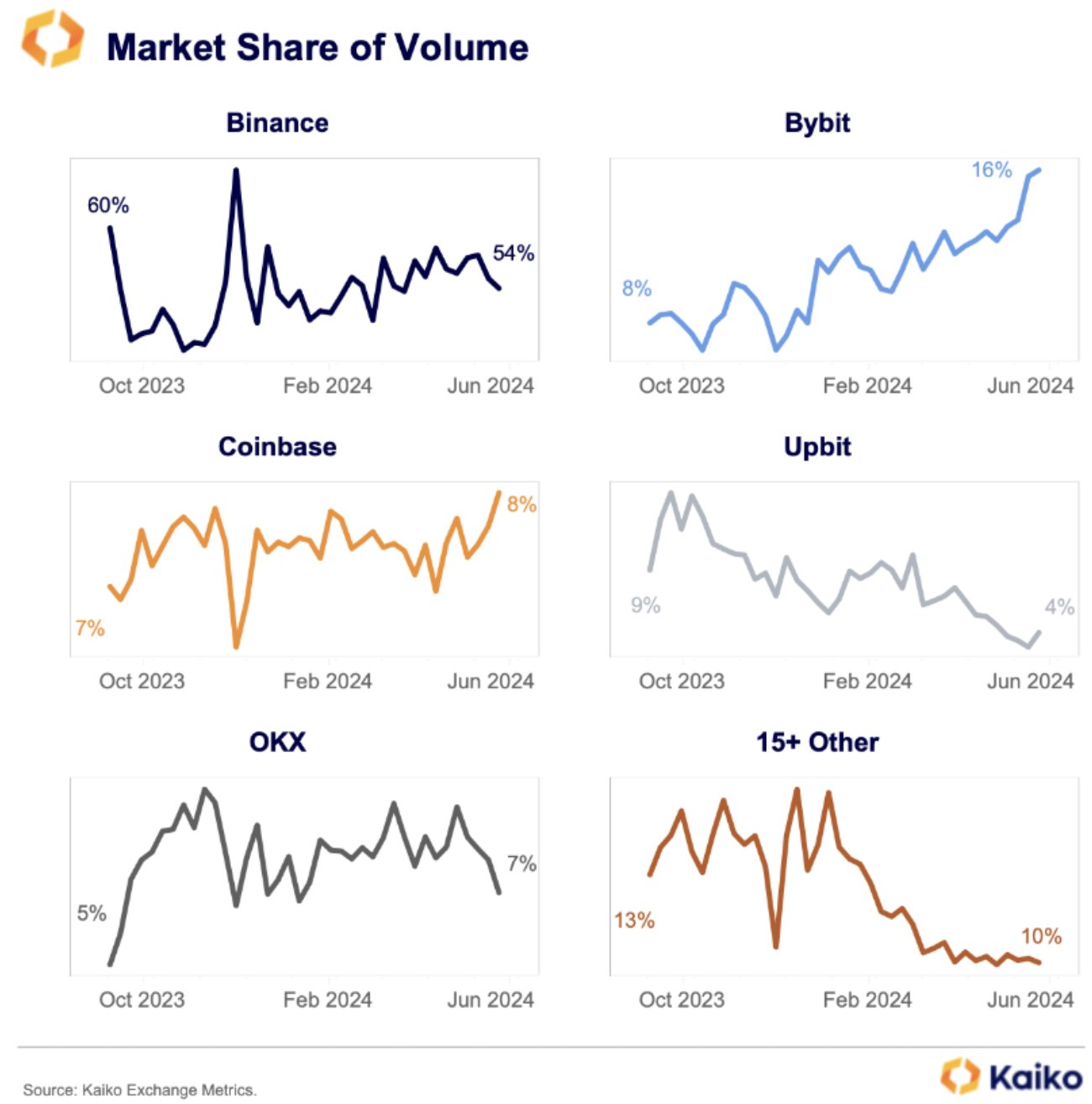

- Bybit ranks as the second largest crypto exchange, while Binance loses market share to regulatory issues.

Market share of volume of crypto exchanges

Crypto market capitalization is up to $2.40 trillion, per CoinGecko data. Trade volume crossed $104.32 billion in the past 24 hours.