Ethereum on-chain metrics point to potential rally

- Ethereum's decreasing exchange supply may be caused by increasing ETH staking.

- Galaxy Research predicts $5 billion in inflows in first five months of Ethereum ETF launch.

- Ethereum needs to overcome the $3,629 key resistance to validate bullish thesis.

Ethereum (ETH) is up nearly 3% on Thursday as upcoming spot ETH ETF launch and key on-chain metrics suggest an ETH rally might be around the corner.

Daily digest market movers: Why declining ETH exchange supply, staked ETH and spot ETH ETF launch primes Ethereum for new high

According to Glassnode data, Ethereum supply on exchanges has continued a downward trend despite recent price rises.

As earlier reported, this signifies that most ETH long-term holders (LTHs) have yet to begin profit-taking. LTHs may be anticipating higher price rises and a new all-time high before they begin locking in profits, especially with the launch of spot ETH ETFs on the horizon.

The increasing yield from ETH staking and restaking protocols could also be fuelling the declining exchange supply. Glassnode's data also shows that the number of staked ETH has increased steadily, meaning most of the declining exchange supply may have flowed to staking protocols.

ETH Exchange Supply vs Staked ETH

With the growth of EigenLayer, Kaiko and Symbiotic and the increasing number of underlying restaking and liquid restaking protocols they power, the ETH exchange supply may continue decreasing. Combined with the potential launch of spot ETH ETFs, Ethereum may be poised for significant price growth in the future.

The Securities & Exchange Commission (SEC) approved issuers’ spot ETH ETF 19b-4 applications on May 23 but have yet to greenlight their S-1 registration statements. Issuers filed amended S-1s last week after the SEC made "light" comments on them.

A recent Galaxy Research report on potential spot ETH ETF inflows also aligns with this prediction. The report stated that Ethereum ETFs could attract up to $5 billion within their first month of trading.

"We expect the net inflows into ETH ETFs to be 20-50% of the net inflows into BTC ETFs over the first five months, with 30% as our target, implying $1 billion/month of net inflows," said Galaxy analyst Charles Yu.

The report said Ethereum's price would be more sensitive to inflows than Bitcoin due to the ETH supply being locked in staking protocols, bridges, smart contracts, and the reduced exchange supply. However, Galaxy also highlighted that potential outflows from Grayscale's Ethereum Trust conversion and the absence of staking could affect ETH ETF inflows.

This follows earlier predictions from Bitwise CIO Matt Hougan that spot ETH ETFs could attract $15 billion in net flows by the end of 2025.

The SEC may give the final approval for spot ETH ETFs on July 4, according to a Reuters report.

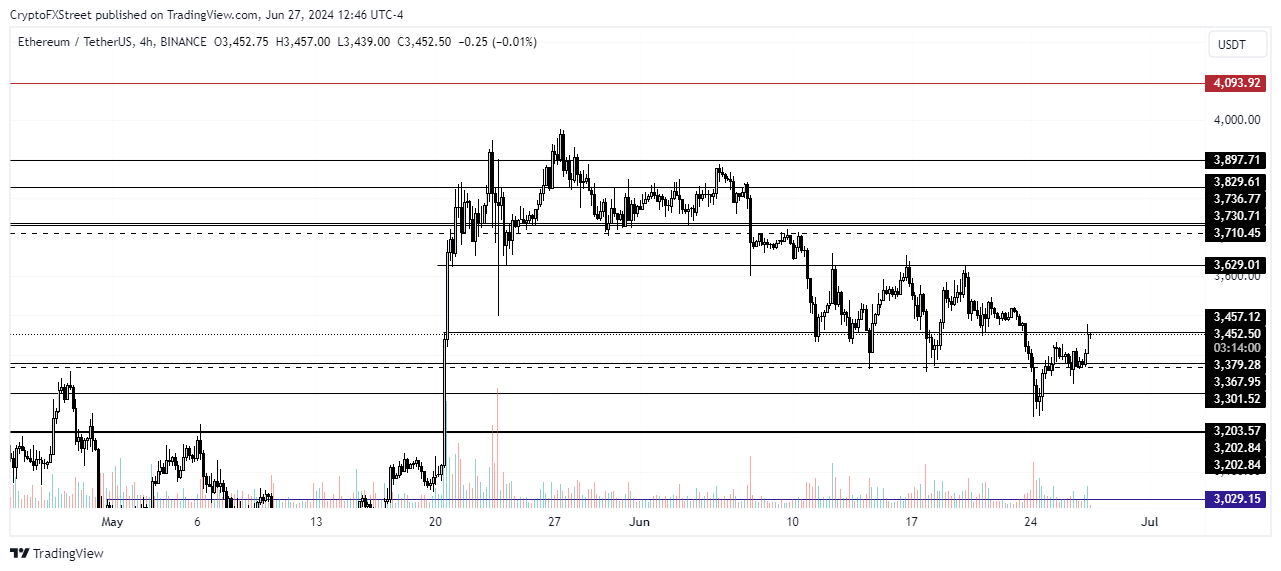

ETH technical analysis: Could Ethereum move past the $3,629 key resistance?

Ethereum is trading around $3,450, up nearly 3% on Thursday following a slight recovery in the crypto market. The move up has seen ETH short liquidations reach $18.31 million, with long only at $4.10 million in the past 24 hours.

ETH Chicago Mercantile Exchange (CME) open interest (OI) reached an all-time high this week. With ETH price also rising slightly, the increasing CME OI indicates US investors may be anticipating a rally. This also signifies potential good inflows in spot ETH ETFs when they launch, potentially causing a price rise in ETH.

ETH/USDT 4-hour chart

ETH could see a rally as the potential launch date for spot ETH ETF draws closer, but it faces resistance at the $3,629 price level. In the past three weeks, ETH bulls have failed on three different attempts to sustain a move above this level. A successful sustained move above the $3,629 price level could see ETH aiming to overcome the next resistance of $3,829.

A move below the $3,300 support could see ETH falling back to collect liquidity around the Fair Value Gap of May 20, extending from $3,110 to $3,457. The $3,203 key support could help prevent a further decline.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.