Top 10 Gold Trading Platforms For Maximizing Earning

In the world of gold trading, choosing the right platform can significantly maximize your earning potential. With numerous options available, selecting a platform that aligns with your trading goals and offers the features you need to succeed is essential.

That's why we've compiled a list of the top 10 gold trading platforms, based on their features, advantages, and reputation. Whether you're a beginner or an expert, you'll find something here that will help you take your gold trading to the next level.

Here is a comparison table about the top 10 best gold trading platforms. Have a quick look.

Top 10 Gold Trading Platforms

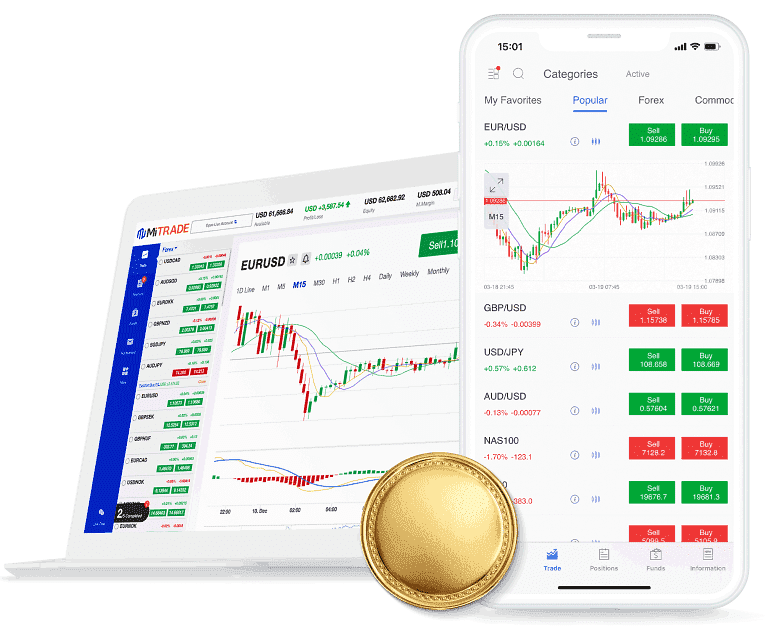

1. MiTrade

MiTrade is an excellent choice for traders seeking an easy-to-use platform with competitive trading costs and a wide range of assets, including gold trading. Regulated by the Australian Securities and Investments Commission (ASIC), the Cayman Islands Monetary Authority (CIMA), and the Financial Services Commission (FSC), ensure the safety of your funds while providing trading access to various precious metals such as Gold (XAUUSD), Silver (XAGUSD), and Platinum (XPTUSD).

The proprietary platform offers a simple and user-friendly interface, advanced charting tools, risk management tools, and educational resources to cater to both professional and novice gold traders. With a minimum deposit of $100 and a minimum trade size of 0.01 lots for many markets makes, gold trading is accessible to a broad audience.

Key features of gold trading include:

More than 400 global markets to choose from, including precious metals like Gold, Silver, and Platinum

Spreads starting from 0 pips for various assets

Access to the proprietary platform for web, mobile, and desktop devices

Demo account for traders to practice gold trading strategies

Max leverage up to 200:1

Pros:

Simple and intuitive platform with advanced tools and resources for gold trading

Competitive trading costs, zero commissions, and transparent spreads

Regulated by multiple regulatory bodies for enhanced safety and security

Negative balance protection ensures your account never goes below zero

Exceptional customer support from dedicated professionals

Multi-platform compatibility with a seamless gold trading experience

Cons:

Limited educational resources compared to competitors

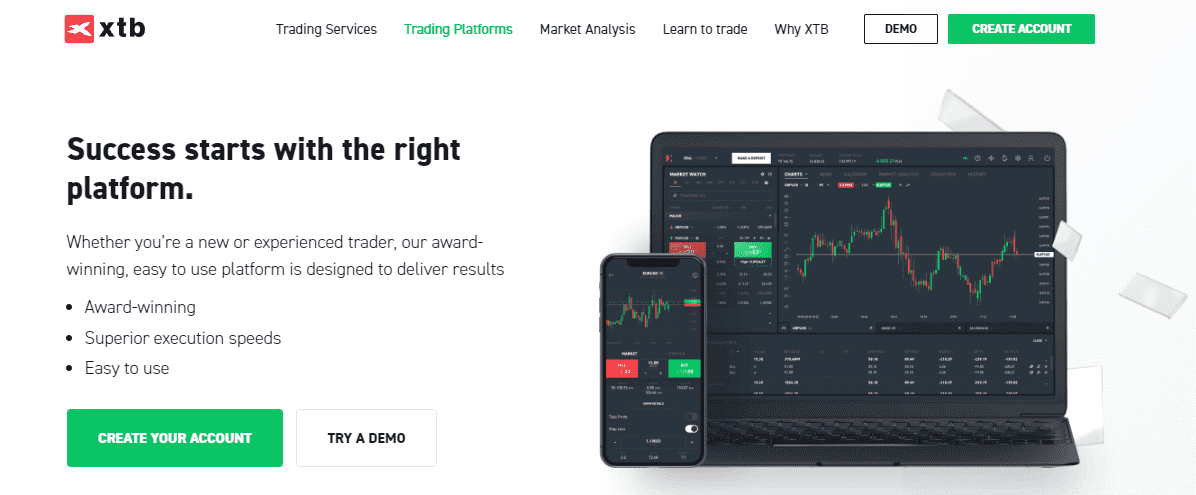

2. XTB

XTB is a highly regarded gold trading broker that appeals to both beginners and professionals, thanks to its user-friendly interface and wide range of assets. With no minimum deposit requirement, traders can easily begin trading gold on the platform.

The platform offers a choice between xStation 5 and xStation mobile, both of which are easy to use and provide fast execution speeds. XTB's web trade platform is compatible with Chrome, Safari, Firefox, and Opera, and a desktop app version is also available. A demo account option allows traders to test out the platform before trading live.

Key features of XTB include:

48 currency pairs available for trading

Maximum leverage of 500:1

Spreads starting from 1 pip for EUR/USD

Access to xStation 5 and xStation mobile trading platforms

Does not accept US traders

Pros:

Extensive educational content available for free

No minimum deposit is required to begin trading

High leverage offered for magnifying positions

Over-the-counter (OTC) trading enabled

Cons:

Limited range of tradable instruments compared to other brokers

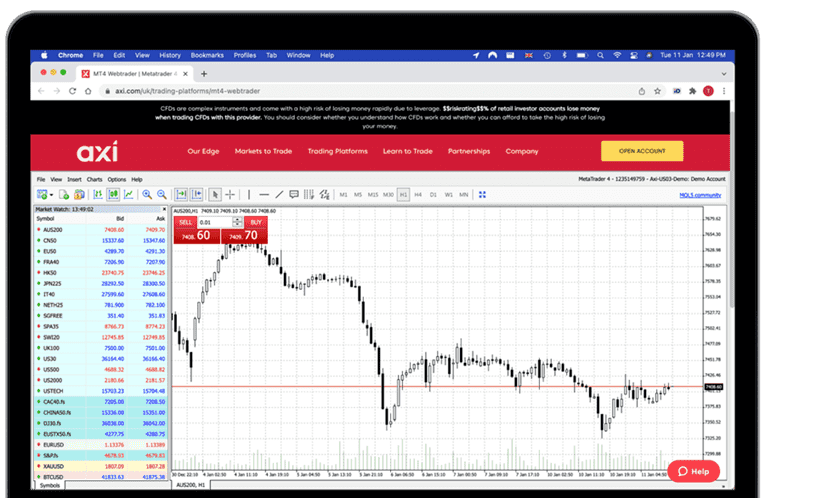

3. Axi

Axi is an award-winning broker offering gold copy trading, making it an attractive choice for beginners and experienced traders. With access to various precious metal markets, such as gold, silver, copper, and platinum, Axi provides a wide range of trading options.

The platform offers a minimum trade size of 0.01 of a standard lot for trading precious metals and allows traders to leverage their positions up to 30:1. Axi's Copy Trading feature lets beginners replicate the trades of professionals, offering a valuable learning experience. A recommended deposit of $250 is suggested, but lower balances are accepted.

Key features of Axi include:

Over 70 currency pairs available for trading

Maximum leverage of 30:1

Spreads starting from 1 pip for EUR/USD

Access to MetaTrader 4 (MT4) platform for Mac, PC, and mobile devices, as well as MT4 web trader

Does not accept US traders

Pros:

Gold Copy Trading feature available for beginners

No minimum deposit required to begin trading

Extensive free educational content, including videos, guides, and webinars

Cons:

Limited platform options with only MetaTrader 4 available

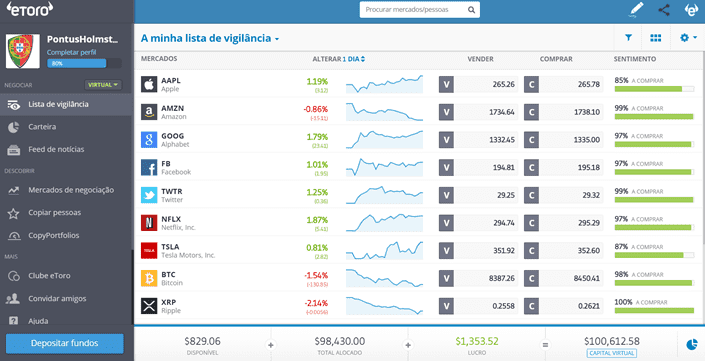

4. eToro

eToro is a versatile platform that caters to traders of all skill levels, making it a top choice for gold trading. Its user-friendly interface is perfect for those who want to trade without being overwhelmed by advanced tools, while professional traders can utilize the platform's advanced features to optimize their analysis.

With a minimum deposit of just $10 for traders in the US and UK, eToro offers a range of funding options, including bank wire, debit/credit card, PayPal, Skrill, and Neteller. Deposits are free, but withdrawals incur a $5 fee. A 0.5% conversion fee applies to accounts funded with currencies other than the US dollar.

Key features of eToro include:

49 currency pairs available for trading

Maximum leverage of 30:1

Spreads starting from 1 pip for EUR/USD

Access to an online trading platform and mobile app

Accepts US traders

Pros:

Wide range of currency pairs

Enables CopyTrading, allowing users to learn from and profit off professional traders

Various payment options available

User-friendly platform suitable for all skill levels

Cons:

Charges conversion fees for non-USD deposits

Inactivity fee of $10 per month after 12 consecutive months of inactivity

5. Tickmill

Tickmill is a platform that caters to traders looking for a low-spread broker, especially for gold trading. The fees and benefits offered by Tickmill depend on the type of account selected, with options including classic, pro, VIP, Islamic, and demo accounts.

New traders can use a $30 welcome bonus to start trading forex, crypto, stocks, bonds, and precious metals on the Tickmill platform. With typical gold spreads as low as 0.09, Tickmill offers one of the lowest spreads in the market. To trade gold on Tickmill, traders can use the MT4 or MT5 platform.

Key features of Tickmill include:

62 currency pairs available for trading

Maximum leverage of 500:1

Spreads starting from 0.1 pips for EUR/USD

Access to MetaTrader 4, MetaTrader 5, and a web trader platform

Does not accept US traders

Pros:

Competitive low spreads, especially for gold trading

Various account types to suit different trading styles

$30 sign-up bonus for new traders

Educational content available for skill development

Cons:

Limited educational resources compared to competitors

Minimum deposit of $100 required to enjoy large positions

6. XM

XM is a regulated broker that offers a variety of incentives for traders, including a $30 sign-up bonus for beginners. Additionally, the platform provides a 50% deposit bonus for up to $500 and a 20% bonus for deposits up to $4,500. Traders can also join the XM Loyalty program and enjoy free VPS services.

With an average spread of 0.35 for gold trading, XM caters to experienced traders who wish to open large trades, offering leverage of up to 1000:1. A zero swap is applied to low accounts, and the minimum deposit required to start trading gold on XM is just $5.

Key features of XM include:

55 currency pairs available for trading

Maximum leverage of 1000:1

Spreads starting from 1.7 pips for EUR/USD

Access to MetaTrader 4, MetaTrader 5, and a mobile app

Does not accept US traders

Pros:

High leverage available for experienced traders

Low minimum deposit requirement

Attractive sign-up and deposit bonuses

Live tutorials, webinars, and seminars for learning and skill enhancement

Cons:

Slightly higher spread for EUR/USD compared to some other brokers

7. IG

IG is a reputable online broker that provides diverse trading options, including shares, indices, options, futures, cryptocurrencies, and forex. With various platforms available, such as ProRealTime, DMA trading, MetaTrader 4, algorithmic trading, and a mobile app, traders can find the tools and features that suit their individual needs.

Gold trading is among the 35 commodity assets offered by IG, with an average spread of 0.3. The platform does not require a minimum deposit for accounts funded via bank transfer, although a $300 minimum deposit may apply if funded with a debit/credit card.

Key features of IG include:

A wide range of trading instruments, including 80 currency pairs, shares, indices, commodities, options, and futures

Maximum leverage of 200:1

Spreads starting from 0.6 pips for EUR/USD

Access to multiple trading platforms, such as ProRealTime, MetaTrader 4, and a mobile app

Acceptance of US traders

Pros:

Numerous currency pairs available for trading

Multiple trading platforms to suit individual preferences

Supports algorithmic trading

Provides free trading tutorials and educational content

US traders accepted

Cons:

Minimum deposit requirement when funding via debit/credit card

Limited selection of crypto trading instruments

8. Webull

Webull is a top-tier online broker that caters to traders of all skill levels, especially those looking for advanced tools and the flexibility of not having a minimum deposit requirement. With a focus on providing a user-friendly platform and a wide range of trading instruments, Webull is an excellent option for traders interested in gold trading, fractional stock ownership, cryptos, indices, over-the-counter (OTC) trading, and ETFs.

To fund their accounts, traders have various options, such as bank wire, debit/credit card, ACH, PayPal, Neteller, and other methods. The absence of a minimum deposit requirement makes it accessible to traders who don't want to risk large amounts of money. Webull charges spread on gold trading and offer 4x day-trading buying power and 2x overnight buying power for margin traders who fund their accounts with at least $2,000.

Key features of Webull include:

A diverse range of trading instruments, including forex, cryptos, ETFs, stocks, and commodities

Floating spreads for EUR/USD

Margin trading with 4x day and 2x night leverage

No minimum deposit requirement

Educational content for beginner traders

Online trading platform and app

Accepts US traders

Pros:

Advanced trading tools for experienced traders

Accessible for traders without minimum deposit requirements

Offers margin trading with leverage

Over-the-counter (OTC) trading available

Educational content for beginners

US traders accepted

Cons:

A limited number of currency pairs compared to some competitors

Higher fees for international wire transfers

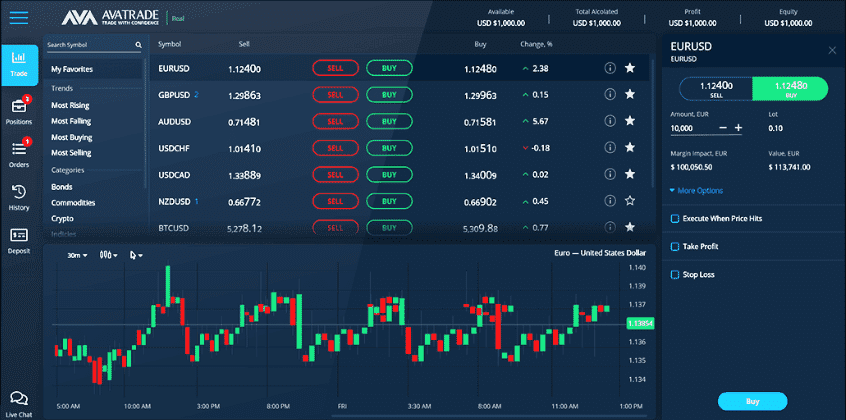

9. AvaTrade

AvaTrade is a well-regarded online broker known for its commitment to high financial and ethical standards regulated by nine financial authorities. This broker offers a variety of trading platforms and a range of financial instruments, including gold, precious metals, commodities, ETFs, stocks, crypto, forex, and indices.

With AvaTrade, traders can choose from several platforms, such as MetaTrader 4, MetaTrader 5, AvaTradeGO, and web trader. The broker also offers automated trading options through DupliTrade and ZuluTrade, enabling traders to automatically duplicate the trades of experienced professionals.

Key features of AvaTrade include:

A wide selection of trading platforms, including MetaTrader 4, MetaTrader 5, AvaTradeGO, and web trader

High leverage of up to 200:1

An average spread of 0.29 for trading gold and 0.9 pips for EUR/USD

Minimum deposit requirement of $100

Free educational content, including market analysis, videos, and guides

Automated trading through DupliTrade and ZuluTrade

Pros:

Multiple trading platforms to cater to different trader preferences

High leverage for increased trading potential

Comprehensive educational resources for beginner traders

Automated trading options to help traders follow professional strategies

Cons:

Limited cryptocurrency trading options compared to other brokers

Some competitors may offer lower spreads

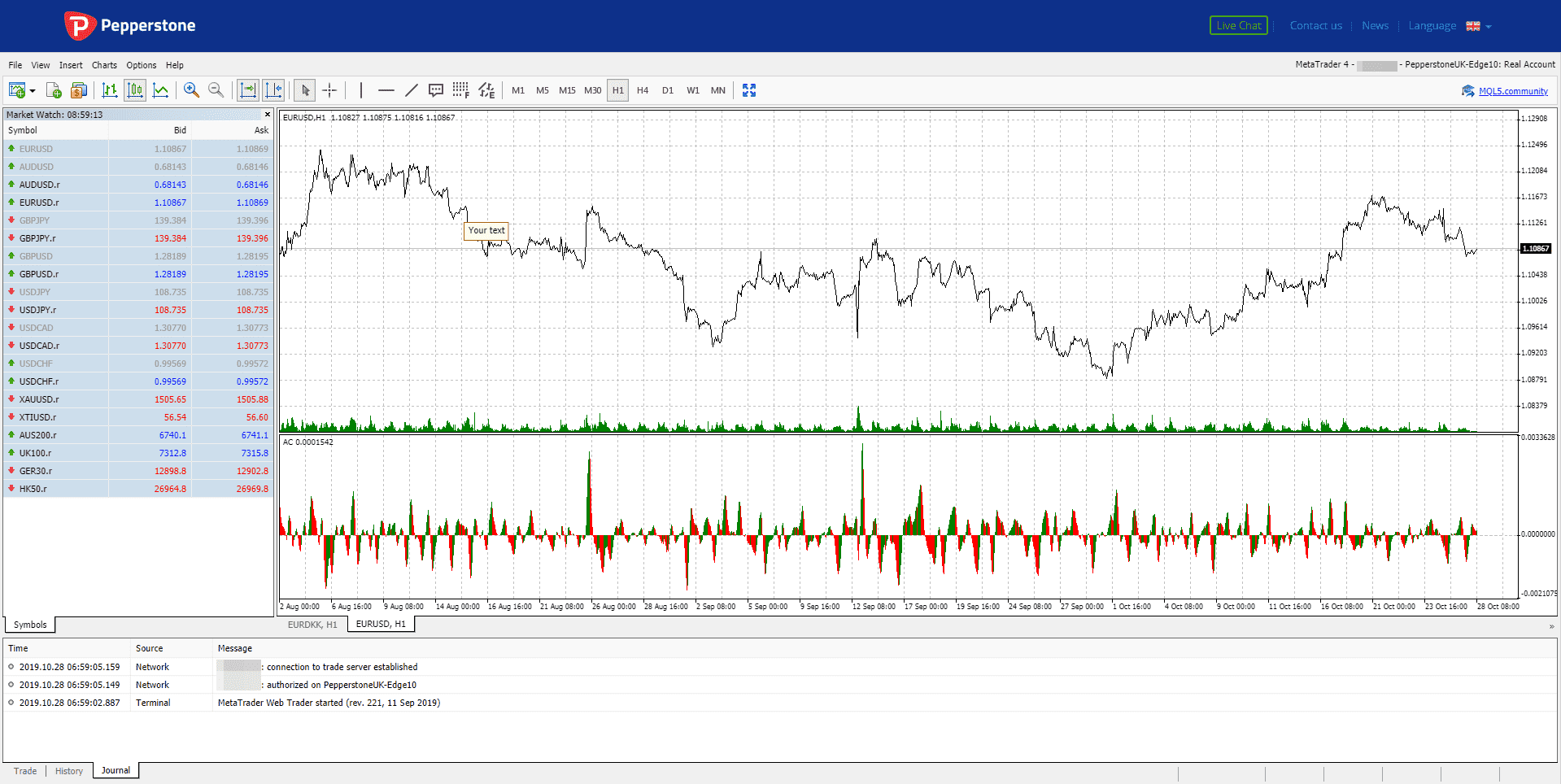

10. Pepperstone

Pepperstone is a highly reputable online trading platform that caters to a wide range of traders, providing access to various financial instruments, including commodities, currency indices, shares, indices, cryptocurrencies, and forex.

One of the standout features of Pepperstone is the variety of trading platforms it supports. In addition to its proprietary trading app, the platform provides access to MetaTrader 4, MetaTrader 5, and cTrader. Opening a Razor Account allows traders to connect directly to TradingView and enjoy better spreads.

Key features of Pepperstone include:

Support for MetaTrader 4, MetaTrader 5, cTrader, and proprietary trading app

No commission fees for trading gold, with an average spread of 0.14 for XAU/USD

Competitive spreads for forex trading, with EUR/USD starting at 0.6 pips

Minimum recommended account balance of AUD $200 (equivalent to US $136)

Multiple funding options, including cards, bank transfers, BPay, PayPal, and Neteller

Regular free webinars, news, and analysis for all traders

Pros:

Wide range of trading platforms, including cTrader, MT4, and MT5

Free webinars and market analysis resources

Low spreads and no commission fees on gold trading

Razor Account offers several benefits, including access to TradingView

Cons:

Limited range of deposit and withdrawal options

Professional account benefits are only available to experienced traders

How to Choose the Best Platform to Trade Gold?

When choosing the best platform for trading gold, there are several factors to consider.

Fees

One of the most critical factors to consider is fees. Look for a broker that offers low fees with no hidden costs. High fees can eat into your profits and may lead to significant losses, especially for active traders. When considering fees for a gold trading platform, you should be aware of the following types of fees and charges:

Spreads: The spread is the difference between the bid (buy) and ask (sell) prices. A tight or low spread means you will pay less when entering and exiting a trade.

Commissions: Some brokers charge a commission for each trade executed. This can be a flat fee per trade or a percentage of the trade's value.

Overnight Charges: Also known as swap or rollover fees, these are charged when you hold a leveraged position open overnight. Since gold trading often involves leveraging, you should be aware of the overnight charges that may apply.

Account Maintenance Fees: Some platforms may charge an ongoing fee for maintaining your trading account.

Deposit and Withdrawal Fees: Some brokers charge fees for depositing and withdrawing funds from your trading account. These fees can vary depending on the payment method you use (e.g., bank transfer, credit card, or e-wallet).

Trading Tools

The trading platform should provide simple execution for beginners and advanced tools and strategies for professional traders to embed into their analysis. Look for a platform that offers real-time data, technical analysis tools, and customizable charts.

Mobile App

With today's fast-paced lifestyle, traders on the go need a platform that offers a trading app that mimics the desktop platform. The mobile app should provide all the key features and be suitable for a mobile screen.

Security

The broker should demonstrate that they are serious about upholding high financial ethical standards. One way to ensure that your funds are safe is to choose a broker that is regulated by financial authorities. Look for a broker that is transparent about its regulatory status and has a good reputation in the industry. Additionally, the platform should have a strong security protocol to protect your personal and financial information.

Examples of well-known regulatory bodies in the financial industry include:

Financial Conduct Authority (FCA) - United Kingdom

Securities and Exchange Commission (SEC) - United States

Australian Securities and Investments Commission (ASIC) - Australia

Cyprus Securities and Exchange Commission (CySEC) - Cyprus

Financial Services Authority (FSA) - Japan

Federal Financial Supervisory Authority (BaFin) - Germany

Swiss Financial Market Supervisory Authority (FINMA) - Switzerland

Financial Sector Conduct Authority (FSCA) - South Africa

These regulatory bodies help ensure that brokers maintain high financial ethical standards, protect clients' funds, and adhere to strict rules and regulations. It is advisable to choose a broker regulated by one or more of these authorities to ensure a secure trading environment.

How to Start Trading Gold?

Here is a step-by-step guide on how to start trading gold with as an example:

Research the gold market and choose a reliable broker like.

Open a trading account with Mitrade and deposit funds.

Choose your preferred trading platform and start trading gold.

Monitor the gold market and your trades regularly.

Set stop-loss and take-profit orders to manage your risks and potential profits.

Close your trades when you achieve your desired results or the market conditions change.

FAQs About Gold Trade Platform

1. Can I trade gold on MT4?

You can trade gold on MT4 with various brokers using gold CFDs. This means that you don't need to buy or sell the actual metal, but only bet on its price movements. Trading gold on MT4 gives you access to advanced charting tools, indicators, and automated strategies that can help you analyze and execute your trades.

2. How do gold traders make money?

Gold trading is a way to make money by betting on the price of gold. You can trade gold in different ways, such as futures, options, spot prices or ETFs. You don't need to own any physical gold to trade it, you just need to settle the difference in cash. Gold trading can be risky, but also rewarding if you know what you are doing.

Conclusion

Gold trading is the buying and selling of gold in various financial markets. Investors and traders participate in gold trading for multiple reasons, such as hedging against inflation, diversifying their portfolios, or capitalizing on market fluctuations.

Choosing the right gold trading platform can make a significant difference in maximizing your earning potential. In this article, we have listed the top 10 gold trading platforms, highlighting their unique offerings and advantages to help you make an informed decision.

Fortunately, the all-in-one trading platform Mitrade ticks all the boxes and easily becomes the best choice. Mitrade offers a user-friendly gold trading experience with safe & secure. Try Mitrade today and take your trading experience to another level.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.