Bitcoin holds up after finding support on key $58,400 level

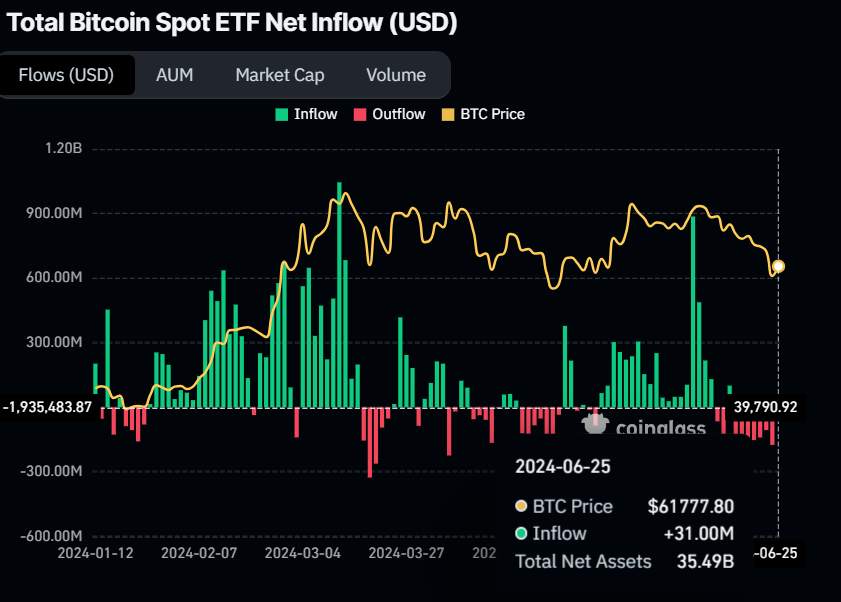

- The Bitcoin spot ETFs received $31 million in inflows on Tuesday, snapping seven consecutive days of outflows.

- US Congressman Matt Gaetz announces a bill proposing Federal Income Tax payments using Bitcoin.

- The German government's transfer of 400 BTC worth $24.34 million to exchanges on Tuesday, following the transfer of 1700 BTC in the last week, may negatively impact Bitcoin's price.

Bitcoin (BTC) price trades above $61,000 on Wednesday after rebounding 2.6% on Tuesday as the broad crypto market recovers slightly. Bitcoin spot ETFs registered inflows of $31 million on Tuesday, snapping a streak of seven consecutive days of outflows. In the US, Congressman Matt Gaetz proposed legislation enabling federal income tax payments with Bitcoin, while in Europe the German Government's transfer of 400 BTC, valued at $24.34 million, added to the recent selling pressure.

Daily digest market movers: Bitcoin spot ETF received $31 million in inflows on Tuesday

- According to data from Coinglass, Bitcoin spot ETFs saw an inflow of $31 million on Tuesday, ending a seven-day streak of outflows totaling $1.13 billion. This uptick in ETF inflows indicates growing institutional and retail interest in the cryptocurrency, which could influence its price dynamics and market behavior. Collectively, the 11 spot BTC ETFs hold reserves amounting to $51.73 billion in Bitcoin.

Bitcoin Spot ETF Net Inflow (USD) chart

- In the last hours, the German Government transferred 400 BTC valued at $24.34 million from its wallet to Coinbase and Kraken exchanges, data from Arkham Intelligence shows. Over the past week, German authorities have moved 1,700 BTC worth $110.88 million to Coinbase, Bitstamp, and Kraken. This significant transfer activity may have fueled FUD (Fear, Uncertainty, Doubt) among traders, potentially contributing to Bitcoin's 4.6% price decline on Monday.

UPDATE: German Government selling additional $24M BTC

— Arkham (@ArkhamIntel) June 25, 2024

In the past 2 hours the German Government has moved 400 BTC to exchange deposits at Kraken and Coinbase.

They have also moved 500 BTC to address 139Po. We have yet to see where these funds are moved. pic.twitter.com/D6QCUv9Jgx

- US Congressman. Matt Gaetz, an American politician, announced on his official Twitter account that he is introducing a bill that would allow the federal income tax to be paid with Bitcoin. If passed, the bill would revise the Internal Revenue Code of 1986 to direct the Treasury secretary to formulate a strategy for accepting the widely used decentralized digital currency.“This is a bold step toward a future where digital currencies play a vital role in our financial system, ensuring that the U.S. remains at the forefront of technological advancement,” Gaetz said

BREAKING: Today, I introduced groundbreaking legislation to modernize our tax system by requiring @USTreasury to implement a program to allow federal income tax to be paid with Bitcoin.

— Rep. Matt Gaetz (@RepMattGaetz) June 25, 2024

By enabling taxpayers to use #Bitcoin for federal tax payments, we can promote innovation,… pic.twitter.com/TO2iPuvrQs

- According to data from Santiment’s Defi liquidations on Aave and Compound Finance, BTC’s recent price decline from $63,210 to $60,293 on Monday has seen liquidations worth more than $1 million in Defi platforms. Historically, these spikes are followed by market recoveries due to the immediate forced selling and opportunistic buying from key stakeholders.

[10.04.02, 26 Jun, 2024]-638549828536003853.png)

Santiment Defi Liquiation chart

Technical analysis: BTC bounces off key support

Bitcoin's price broke below the descending wedge on Monday, declining approximately 7.5% from its daily high of $63,369 to a low of $58,402. After retesting its crucial weekly support near $58,375, BTC rebounded by 5.8%, closing at $61,806 on Tuesday. BTC trades at around $61,654 at the time of writing, edging down approximately 0.2% on Wednesday.

If the weekly support at $58,375 holds, Bitcoin could encounter resistance at several key levels.

- The lower boundary of the descending wedge sits around $62,000.

- The descending wedge's upper boundary and daily resistance hovers near $63,956.

- The 61.8% Fibonacci retracement level and the weekly resistance are at $66,631 and $67,147, respectively.

A breakthrough above these resistance barriers could propel BTC's price towards retesting the next weekly resistance at $71,280.

The Relative Strength Index (RSI) is currently well below 50 on the daily chart, close to oversold levels, while the Awesome Oscillator (AO) is below its zero level. For bulls to stage a convincing comeback, both momentum indicators would need to sustain positions above their respective thresholds of 50 for RSI and zero for AO.

BTC/USDT daily chart

However, if BTC closes below the $58,375 level and forms a lower low on the daily time frame, it could indicate that bearish sentiment persists. Such a development may trigger a 3% decline in Bitcoin’s price, revisiting its previous low of $56,552 from May 1.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.